Reading This Time Is Different has taught me a lot about economic history, but it's taken a while because it's written very much like a dry academic paper than most nonfiction. Good news: it also has pretty pictures.

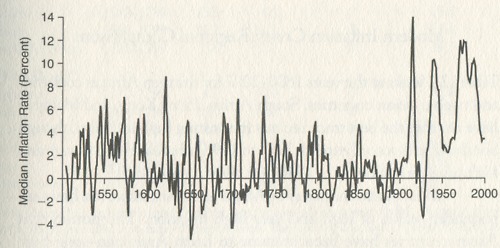

This graph struck me as very telling of our age—while the 10-year average inflation rate is always positive, only in the last generation has it stopped dipping below 0 every so often, and all of the most recent local maxima are higher than any age before.

From the book (page 179):

Perhaps it may seem excessive to devote so much attention here to currency debasement when financial crises have long since moved on to grander and more extravagant schemes. Yet the experience of debasement illustrates many important points. Of course, it shows that inflation and default are nothing new; only the tools have changed. More important, the shift from metallic to paper currency provides an important example of the fact that technological innovation does not necessarily create entirely new kinds of financial crises but can exacerbate their effects, much as technology has constantly made warfare more deadly over the course of history.

That's one hell of an analogy. The book goes on to explain that inflation is a tool used by sovereigns to reduce the value of debt owed, but the occurrence of sovereign default hasn't changed commensurately over the course of the graph.

And in case you don't follow Three Panel Soul: